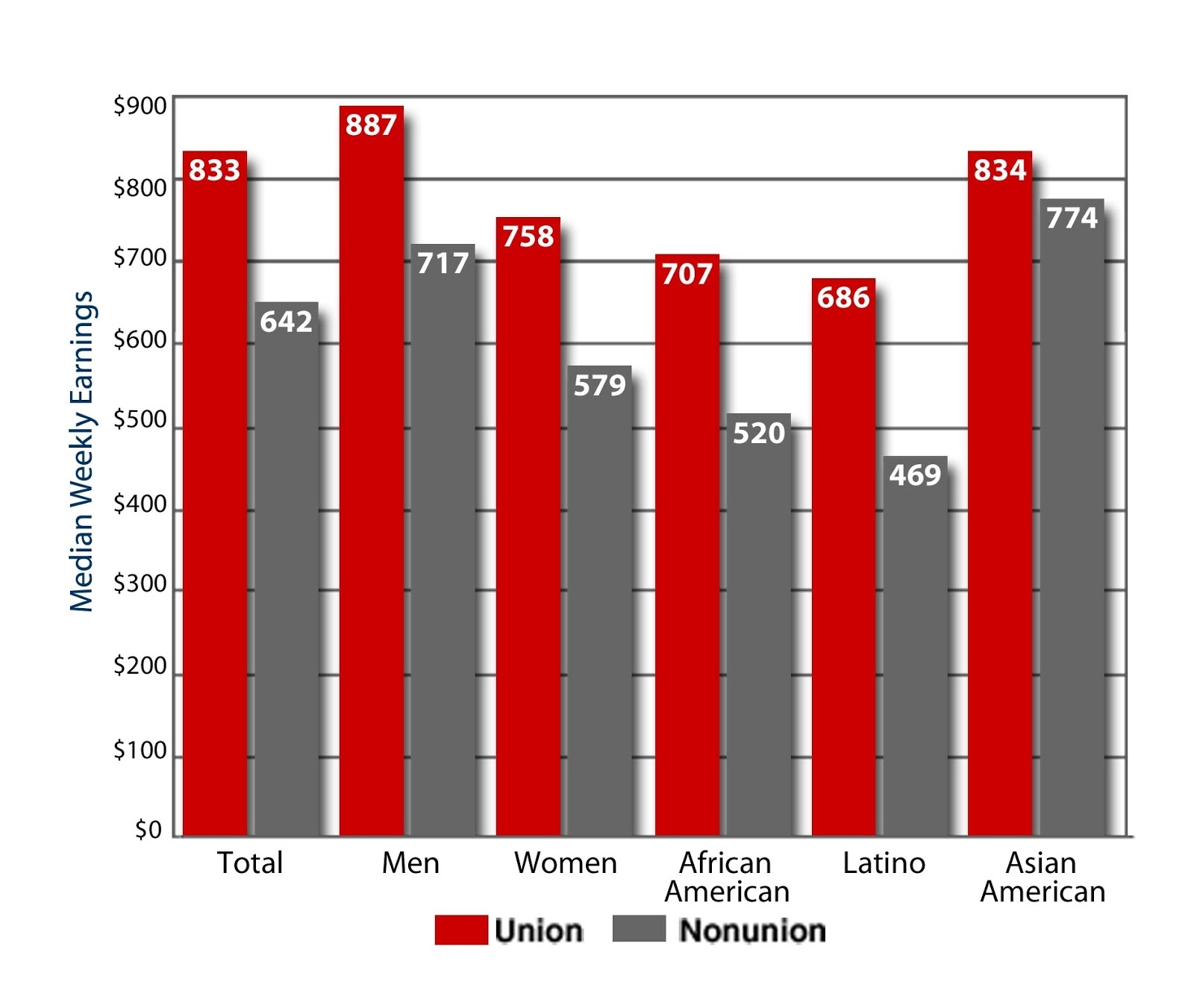

Union membership raises workers’ pay by almost 30 percent and helps narrow the income gap for women and minority workers.

Source: (click here) U.S. Department of Labor, Bureau of Labor Statistics, "Union Members in 2006," January 2007.

Prepared by the AFL-CIO.

We've heard of the looming retirement security crisis, but this statistic is extremely sobering: The majority of black and Latino workers (62% and 69%, respectively) do not own assets in a retirement account. This is from a new report by the National Institute on Retirement Security (NIRS) released this week.

To make things worse, three out of four black households and four out of five Latino households ages 25 to 64 have less than $10,000 in retirement savings, compared to one out of two white households.

“Those are startling findings,” says Diane Oakley, executive director of NIRS. “The typical household of color has nothing saved in a retirement account.”

A new report calculates the severity (click here) of the U.S. retirement security racial divide. The analysis finds that every racial group faces significant risks, but people of color face particularly severe challenges in preparing for retirement. Americans of color are significantly less likely than whites to have an employer-sponsored retirement plan or an individual retirement account (IRA), which substantially drives down the level of retirement savings.

Race and Retirement Insecurity in the United States examines retirement readiness racial disparities among working households age 25-64. It analyzes three key areas – workplace retirement coverage, retirement account ownership, and retirement account balances....

Only 54 percent of black and Asian employees and 38 percent of Latino employees age 25-64 work for an employer that sponsors a retirement plan, compared to 62 percent of White employees.

The problem with any of this is the obvious abuse of the private and public sector in the underfunding of the PROMISED pensions.

The unions need to be less trusting in allowing employers to keep the pension in a trust fund. The unions need to take control of these monies and invest them in assets that will exist beyond the need for the pension distributions.

The existence of a retirement system that does not work for most workers underscores the importance of preserving and strengthening Social Security, defending defined-benefit pensions for workers who have them and seeking solutions for those who do not.

The problem with any of this is the obvious abuse of the private and public sector in the underfunding of the PROMISED pensions.

The unions need to be less trusting in allowing employers to keep the pension in a trust fund. The unions need to take control of these monies and invest them in assets that will exist beyond the need for the pension distributions.

The existence of a retirement system that does not work for most workers underscores the importance of preserving and strengthening Social Security, defending defined-benefit pensions for workers who have them and seeking solutions for those who do not.