Click on picture to enlarge it.

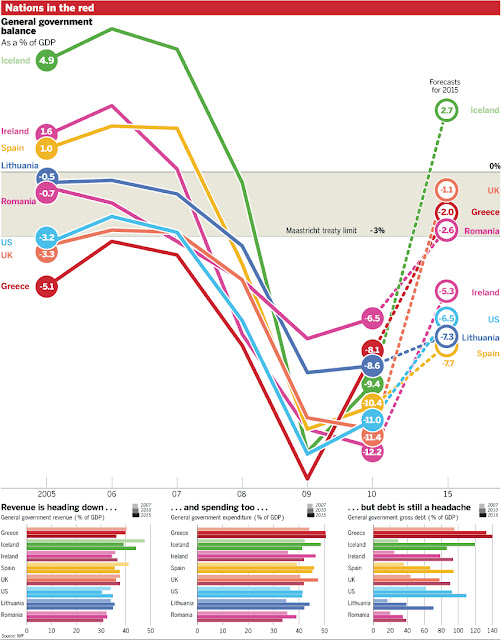

...Add it all up and the simple fact is (click title to entry - thank you) our domestic economy and the global economy are in for real challenges. Robust recovery? I don’t think so. The following pictorials paint a very ugly picture for what lies ahead. I direct you to the pictograph in the lower right which projects that the U.S. Gross Debt as % of GDP will approach 110% in 2015....

This is the argument the Right Wing CHRONICALLY makes as a 'foretelling' to what will occur with the USA. There are many ways of measuring debt, but, to compare the United States as an equivalent to Iceland, Greece, Ireland, Spain, Lithuania and Romania is not exactly what I would call a good analogy. In the same light, the United Kingdom is not in that ball park either. So, the Right Wing might like to make bad analogies, but, the economies of these small countries aren't even comparable to what the USA and the UK comprises as their resources and potential. As far as I am concerned it is a defunct argument. The USA's economy is far different than many nations and predicting its future based on wrongful analogies is not prudent. The global community looked to the USA post October 2008 to salvage their own economies.

The 'reserves' of the USA far exceed most countries on Earth without much exception. Comparable economies have to be the 'balance' of major countries of the European Union and Japan along with Australia. So, this is a really poor argument.

If Japan, the US, the EU and Australia decided to bring their economic strengths into a 'cooperative' of sorts, that really would be an interesting outcome. I doubt the WTO would appreciate it.