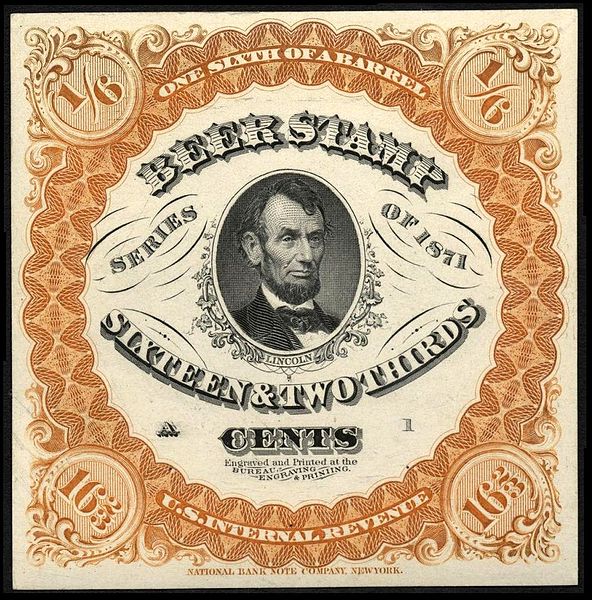

Excise taxes are taxes paid when purchases are made on a specific good. It is a domestic tax. It was called duty.

Samual Adams once stated, "A hateful tax levied upon commodities, and adjudged not by the common judges of property, but wretches hired by those to whom excise is paid."

An excise tax is the way a society disincentives the use of some goods, such as alcohol or cigarettes. The excise tax usually goes to a specific expenditure of the government, such as educating the public about the dangers of drunk driving.

Nevada has an excise tax on prostitution, "An excise tax is hereby imposed on each patron who uses the prostitution services of a prostitute in the amount of $5 for each calendar day or portion thereof that the patron uses the prostitution services of that prostitute."

And then a tax can be placed on a tax. That is called a surcharge.

January 15, 2014

Samual Adams once stated, "A hateful tax levied upon commodities, and adjudged not by the common judges of property, but wretches hired by those to whom excise is paid."

An excise tax is the way a society disincentives the use of some goods, such as alcohol or cigarettes. The excise tax usually goes to a specific expenditure of the government, such as educating the public about the dangers of drunk driving.

Nevada has an excise tax on prostitution, "An excise tax is hereby imposed on each patron who uses the prostitution services of a prostitute in the amount of $5 for each calendar day or portion thereof that the patron uses the prostitution services of that prostitute."

And then a tax can be placed on a tax. That is called a surcharge.

January 15, 2014

KAILUA-KONA, Hawaii (AP) — Mayors across Hawaii (click here) say they'd like a way to be able to raise the general excise tax in their counties.

The Hawaii Council of Mayors is asking the Legislature to allow counties to add a surcharge of up to 1 percent to the state GET.

Big Island Mayor Billy Kenoi said mayors want the flexibility to raise the tax with a surcharge instead of having to go through the Legislature every year for a greater share of the transient accommodations tax, West Hawaii Today reported Wednesday. "Nobody's proposing to raise the excise tax," he said....

Visitors pay about one-third of the general excise tax, Kenoi noted....

And then there is the income to states from federal spending, such as the military and infrastructure projects